If you understand your price is competitive, then prepare for a sluggish start just in case. Prep your finances, so that you can wait out the market for as long as possible, if required. Keep in mind that offering commercial property typically takes a lot longer than offering houses. Do not wait up until a possible purchaser requests details to have it ready. Some chances only knock as soon as and after that disappear to knock someplace else. Attempt to anticipate all the information a seller might desire. Set this aside, so that you can provide it by means of email or in a professional binder for potential buyers to take an appearance. Nevertheless, with commercial property, additional investigation is needed into seismic strength, underlying renter covenants, operational efficiency, developing services condition, outstanding guarantees or authorizations, and so on. In commercial leases, it is more typical to find particular terms by which the parent company will ensure the lease must the occupant ended up being unable to fulfill its commitments. This is a beneficial protection that is not commonly found in the residential space. Investing with a supervisor like Jasper permits financiers to leverage the understanding of an internal investment team, which carries out robust and extensive diligence on every property brought to market taking the headache out of business property financial investment.

In home, it is typical to deal with a single tenant or household. However, in a multi-let business structure owners might see upwards of 20 renters - Which combines google maps with real estate data. This comes with its obvious functional challenges that need knowledgeable property supervisors to help in collecting rents, advising repairs/maintenance and making sure a comfortable tenant experience that helps retain renters and keep jobs to a minimum. It is vital that investors partner with quality commercial home operators to maximise the worth of their possessions. On the property side numerous financiers will handle the properties themselves and if realty is not their core expertise this can sometimes cause mismanagement implying the optimum worth is not extracted from the financial investment.

Occupants of commercial residential or commercial property normally sign long-term contracts, with leases in excess of ten years not unusual. For commercial home, this is typically constructed into the lease with repaired and/or market rent evaluations. Certain lease terms may include a mechanism that limits the leasing from going lower than the previous level (cog stipulation). It is uncommon to find this structure within domestic leases which lowers income certainty for a financier in the residential space. In addition, industrial residential or commercial property probably allows for more opportunities to augment rental growth through active and efficient asset management that launches worth and enhances the returns on residential or commercial property.

Nevertheless residential rents are paid by homes which indicates leas are tied to family incomes and over the past years wage development in OECD countries has actually been a dismal 6. 3% in total considering that 2008. For investors, the bottom line means you can charge more lease per square meter for business space than residential area, leading to a much better return on your investment. On average, a commercial home will yield about 5% to 8% per year, depending on the place and supply/demand for the industrial area, and homes normally yield 1% to 5% annually. In http://mcdonaldauto.ning.com/profiles/blogs/3-easy-facts-about-what-is-a-real-estate-broker-described basic, due to the long-lasting nature of commercial residential or commercial property leases, cash flows are far more stable and safe and secure than those in house.

This indicates a greater risk profile of the hidden income stream for the financier relative to commercial property (What do real estate brokers do). Unlike industrial residential or commercial property, the lease structure for domestic home normally needs the owner to take duty for repair work and routine upkeep. It prevails in commercial property for the bulk of property management, repairs, regular upkeep to be the responsibility of the tenant, nevertheless, the level of this varies with the lease. Both sectors have actually traditionally been afflicted by liquidity issues, the capability for a financier to rapidly get their money out of their investment. The commercial sector has actually responded with listed residential or commercial property funds and REITs (see our post on REITs here) which provide investors indirect access to commercial residential or commercial property and improves liquidity for individuals.

The introduction of a secondary trading platform will substantially enhance liquidity in the direct commercial home area. Jasper currently has plans to roll out such a platform, which will give investors access to trade industrial residential or commercial property shares on a secondary platform. There are presently no established platforms that accommodate the residential area, existing financiers are forced to run a campaign through a realty representative if they are aiming to leave their financial investment. This procedure can take anywhere from 30 to 50 days to complete. The residential market can present rather irrational evaluations, driven by belief of owner-occupiers more than that of investors.

Getting My What Is A Cma In Real Estate To Work

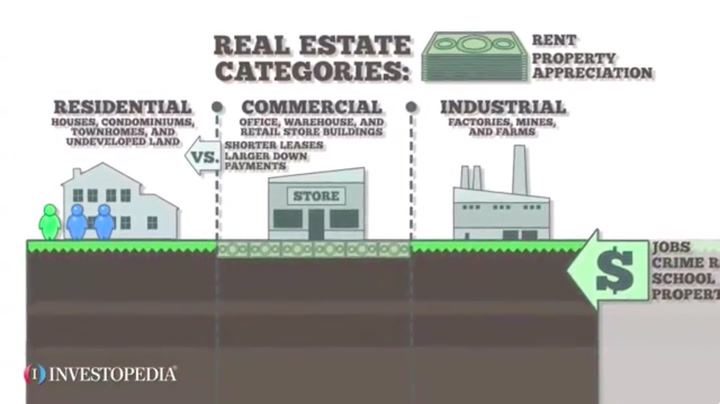

This can cause higher volatility, with the domestic market perhaps more immediately exposed to movements outside one's control such as modifications in interest rates. Motions in rate of interest affect various sectors of the commercial market with differing impact and over differing timescales - How to get a real estate license in oregon. In industrial home, appraisals are much more Go here figured out by principles - particularly, baker financial group the present worth of future earnings streams. When market conditions are steady and a residential or commercial property is managed correctly, both residential and business residential or commercial properties can be strong financial investment chances. Commercial residential or commercial property investment normally tends to come with greater risk, but greater reward. Potential investors must think about business and home sectors independently, or their investment strategy might end up being out of balance.