After doing your research, you will have a variety of the preliminary investment you can anticipate to make in getting going. It's possible to get going with simply $1,000 (and even less in some situations). But you must also have an objective and understand yourself. Just how much threat do you desire? How much work do you desire to put in?Write down your objective. Next, reverse-engineer what you require to do to get to that point - what is the initial financial investment amount needed to get started?At some point, you are going to come to the awareness that you need to put away your disposable income so that you can money your property investing dreams.

You can do this, and the crucial thing is to start with the end goal in mind. You can raise funds quickly by dealing with your side hustle or following your new budget plan. It is essential to understand your alternatives, as some have higher risks and greater financial investment requirements. The very first choice is in standard realty investing, which includes purchasing rental residential or commercial properties and leasing them out to occupants. Standard real estate investing is a popular method to grow your wealth, however it likewise features some cons that you must take a look at before you make the leap. Conventional property investing requires searching dozens of listings and going to a number of residential or commercial properties before you pick the right home appropriate for rental purposes.

Upkeep and home management are frequently overlooked responsibilities that are essential to effective rental genuine estate investments. If you decide to buy the home as an owner occupied home, there is an extra threat where you are responsible for a large mortgage Click here to find out more on the residential or commercial property with a substantial threat in case of a decline in the real estate market. While these threats are not enough to turn someone off completely from conventional property investments, you need Great site to understand what you are obtaining into prior to you decide. A newer option to get started down the traditional realty course is.

You can totally acquire your rental homes online, and they have tools to help you manage them also. Read our Roofstock review here, and If owning and managing your own rental residential or commercial property is not appealing to you, but you still wish to grow your portfolio through property investing, crowdfunded realty investing may be a better alternative for you. When you take part in crowdfunded real estate investing, you belong to a group of individuals who pool their cash with other investors, and after that lend or invest that money with knowledgeable rental realty financial investment property owners. You stand to benefit from the experienced investor's abilities with a minimal financial investment of time with minimal risk, depending on the investment.

6 Simple Techniques For How Much Does A Real Estate Agent Make

You can likewise manage your investment online, and you will get a summary with year-end tax info as well.Crowdfunded property investing is an extremely popular option because you do not have to look for property, get a mortgage, screen or manage renters or handle the residential or commercial property. More notably, somebody else is accountable for the property loans. Your risk and work are decreased, yet the potential for profit still exists. Prior to crowd financing, personal securities might not be marketed openly under the Securities Act of 1933 - How to get a real estate license in ohio. As an outcome, it was challenging to get info about private securities financial investments unless you associated with wealthy investor who bought six-figure deals. While crowdfunding is an appealing alternative, you need to investigate the company and the.

alternatives to ensure that the business is legitimate and likewise a good fit. You need to understand the minimum financial investment amount to make sure that the offer will work for you. You will desire to understand how long they have actually stayed in business, in addition to their standards for debtors and financiers. Last but not least, you need to know the fees being charged for their service. Here are two of our favorites: is among the largest Property Investment Trusts( REIT). You invest with others in a basket of real residential or commercial properties. Check out Fundrise here. You have to understand the dangers prior to making the westgate timeshare financial investment. One of the crucial dangers involved is buying a residential or commercial property and needing to sell it at a considerably lower rate due to market conditions or other conditions beyond your control. Another typical error consists of the timing of purchases and sales may lead to substantial losses or losing out in a deal or the market choosing up ahead of your forecast requiring you to buy the very same product that was offered for a deal at a premium. If you're owning the leasing, maintenance and other big expenditures can likewise be a challenge. Among the key determining factors is how the residential or commercial property is classified, and how it is used. You do not want to part with a major piece of the returns you earn from a financial investment as taxes. The one and the only way to ensure this is by understanding the tax implications of any home investment well beforehand. A fundamental part of how the residential or commercial property is categorized is how the property is treated under rental realty activities. Go through the existing tax schedules and also get a clear image about the varying rates that use. Always talk to a tax expert if you have questions or issues. Use the action guides connected above to fast lane your realty investment education, however remember to do your research study based upon your own distinct monetary scenario.

to reach your maximum capacity in property investing. Published by: Kaplan Property Education Updated: May 19, 2020Deciding to end up being a genuine estate agent is a significant move in anybody's profession journey. People enter the field of property from, and.

at. Everyone has various reasons they believe real estate is the correct profession option for them. However, one concern regularly originates from individuals looking to enter the realty market: "How do I end up being a realty representative?" The basic response is," it depends." It mostly depends on where a private wishes to practice real estate. Ending up being a genuine estate agent needs a state license. But, there are a couple of standard requirements that are constantly constant. To be qualified to become a certified real estate sales representative or representative, you should: Be at least 18.

The Definitive Guide to What Is Cap Rate Real Estate

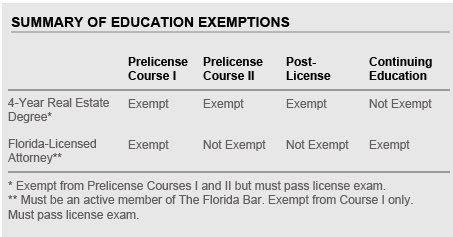

or 19 years old (depends on the state) Have legal US residency, Total your needed prelicense education() Pass your state real estate license assessment, These items represent the high-level checklist of what it takes to become a licensed property representative, however there are a great deal of choices you require to make along the way that will determine whether your journey achieves success or not. The initial step in this procedure is. How to generate real estate leads. As a genuine estate salesperson, every day is invested working for you.